td ameritrade tax calculator

FIDELITY MASSACHUSETTS AMT TAX-FREE I Mutual Fund. The user controls the medium HTML PDF TXT and XLS for.

Crypto Com Exchange Review By Fxempire In 2022

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

. Mark-to-Market Trader Taxes 4 min read. TD Ameritrade provides information and resources to help you navigate tax season. Contribution and Eligibility Calculator.

Mailing date for Form 2439. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. Tax Reports-This section is a report-filtering page that generates custom reports to satisfy a tax report request.

Mailing date for Forms 4806A and 4806B. Some states may have lower tax rates within each federal tax bracket depending on the investors income level and type of filing. Please consult a legal or tax advisor for the most recent changes to the US.

Your tax forms are mailed by February 1 st. Click TD Ameritrade from the list of financial institutions. Thinkorswim 10 years in a row Active Trading 2 years in a row Options Trading Customer Service and Phone.

TD Ameritrade can suit beginners with commission-free trading of stocks and ETFs. The calculator assumes the highest tax rate for the state you select. You can also view whether your positions are categorized as long term or short term.

TD Ameritrade opened individual accounts for all 4 of my siblings. This function is broken on the TurboTax end. Late January to early February.

Your tax forms arrive at home. Fidelity Massachusetts AMT Tax-Free Money Market Fund Class S. ItsDeductible donation tracker.

Were getting your 1099 and 1098 tax forms ready. The information provided by these calculators is intended for illustrative purposes only and is not intended to purport actual user-defined parameters. This TEY calculator is intended to be used only as a general guideline when determining taxable equivalent yields for fully taxable securities.

She says that if your estimate of itemized deductions is close to the threshold the calculator will provide tips on how to get over the top such as bumping up charitable donations or scheduling a last-minute medical appointment. From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click FederalClick the Investment Income dropdown click the Gain or loss on the sale of investments dropdown then click Stock data import. Check e-file status refund tracker.

TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. Fidelity Massachusetts AMT Tax-Free Money Market Fund Institutional Class. Some people want to travel the world with their loved ones while some wish to pursue their dream of opening a business.

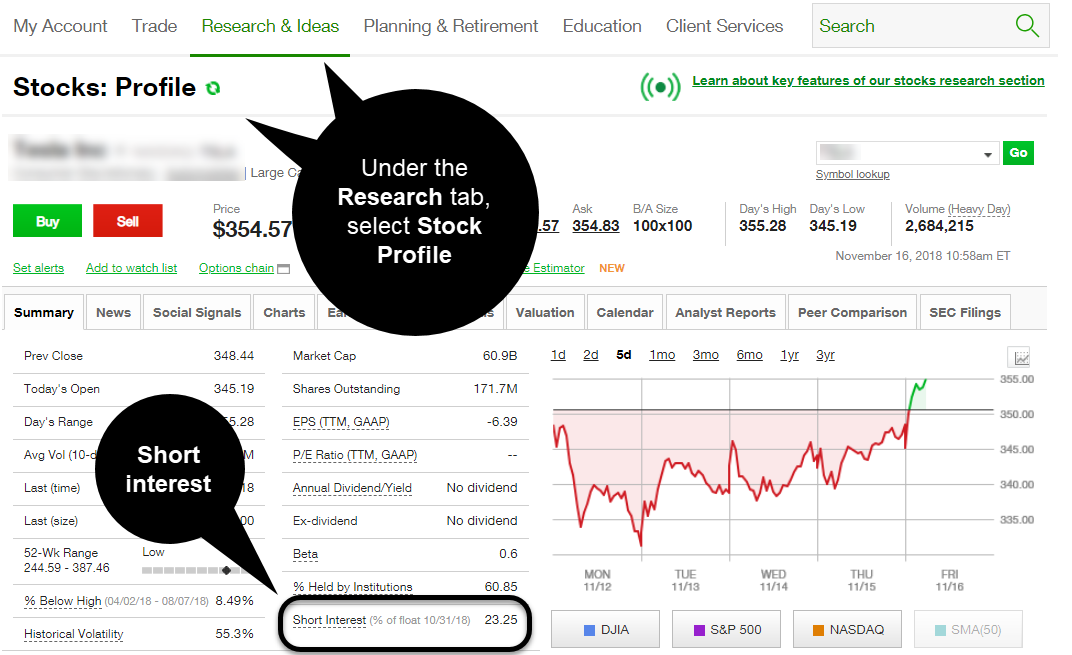

People have different goals or plans if we say for their retirement. This document will provide instructions on how to view an accounts cost basis to determine unrealizedrealized gainslosses. Tax Resources Center TD Ameritrade Tax resources Check out our extensive archive of articles tools and tax calculators to help you prepare your taxes this year and evaluate potential tax implications of future investment decisions.

The firm was rated 1 in the categories Platforms Tools 11 years in a row Desktop Trading Platform. The default figures shown are hypothetical and may not be applicable to your individual situation. Our retirement income calculator determines how much you need to retire based on your current age income and health.

To import your TD Ameritrade account information into TaxAct. My father passed away in 2019 and I was a beneficiary on his TD Ameritrade account. The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2.

The Fund invests in municipal securities that are exempt from. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Mailing date for Form 1042-S and Real Estate Mortgage Investment ConduitWidely Held Fixed Investment Trust REMICWHFIT statements.

Census data on employees if applicable. Figuring out what you owe in income taxes might seem daunting but there are ways to make it easier. Tax code and for rollover eligibility rules.

Calculate the required minimum distribution from an inherited IRA. It shows wash sale information and any adjustments to cost basis when applicable. Thinkorswim 10 years in a row Active Trading 2 years in a row Options Trading Customer Service and Phone.

TD Ameritrade Consolidated1099 Download. Trade for a Living. TD Ameritrade offers tips on how to calculate your income taxes where to find the a helpful income tax calculator the types of deductions you may be eligible for and more.

From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click Federal. The Fund seeks to provide current income exempt from regular federal and New York State and New York City income tax consistent with the preservation of capital. And The Toronto.

Be sure to consult a financial professional prior to relying on the results. TD Ameritrade does not provide tax advice. With TD Ameritrade annuity calculator you can see how much you have in your savings and how much of it is going to be used as a retirement investment.

I can log onto TD Ameritrade and see the PDF version of my 1099 but I cannot download it into TurboTax. Past performance does not guarantee future results. Click the Investment Income dropdown click the 1099 import from institution.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. FIDELITY MASSACHUSETTS AMT TAX-FREE S Mutual Fund. Use our required minimum distribution calculator to estimate the distributions you are required by law to withdraw annually based on your birthdate.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. While the funds cannot remain in a tax-deferred account they can be put into a taxable account. The firm was rated 1 in the categories Platforms Tools 11 years in a row Desktop Trading Platform.

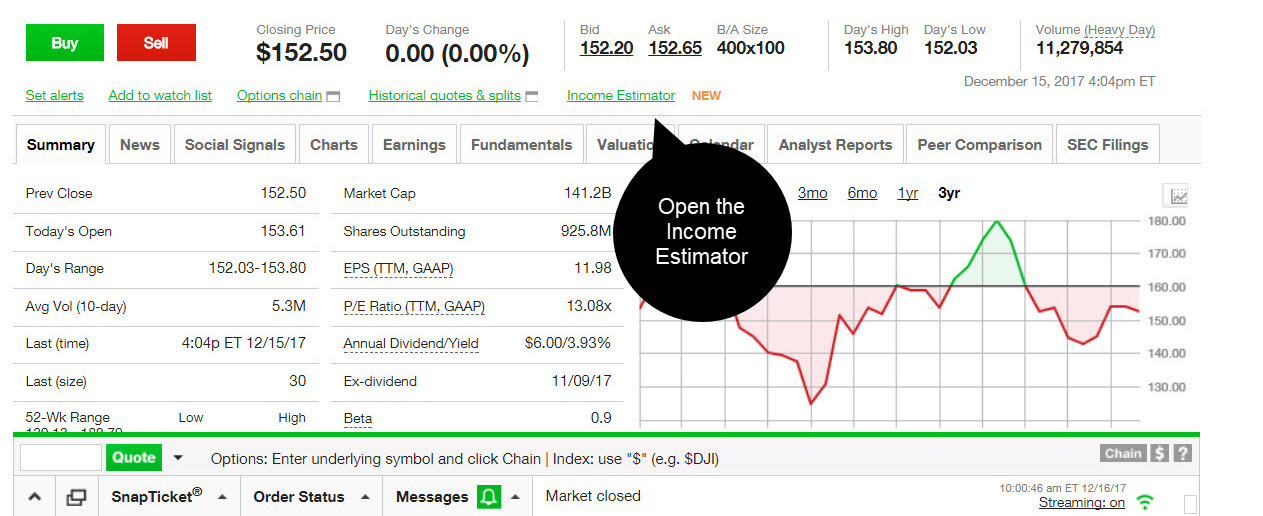

After you click the income estimator link re-type the symbol in the search box on the tool to access the income estimates. Keep an eye out for W2s from your employer. You should have received your 1099 and 1098 forms.

Learn more 1099 Deadline Myth Buster. For illustrative purposes only. I am using the TD Ameritrade Account Number and eleven character Document ID but TurboTax says they are an invalid combination.

This includes month and year of hire birthdate and W-2 Income. Click Electronic Import click the. Simplify the process of calculating contributions and determining employee eligibility in your business retirement plan with the Small Business Retirement Contribution Calculator.

1099-INT forms are only sent out if the interest earned is at least 10. Nuveen New York Select Tax-Free Income Portfolio the Fund is a diversified closed-end management investment company. RMD amounts depend on various factors such as the beneficiarys age relationship to the beneficiary and the account.

The Ticker Tape One stop shop for a variety of tax-related articles. Federal tax-filing deadline and IRA contribution deadline. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099.

Because of its affiliation with Charles Schwab clients may soon get easy access to products like a no-fee robo advisor and fractional shares starting at 5. They can also find a collection of mutual funds that charge no transaction fees.

Td Ameritrade Income Estimator Tool Youtube

2022 Td Ameritrade Review Pros Cons Benzinga

The Short And Long Of It Your Top Questions On Short Ticker Tape

See Your Allocations From The Inside Out With Portfol Ticker Tape

Actionable 100 Year Analysis Of S P 500 What S The Best Strategy To Maximize Returns Strategies Stock Market Good Things

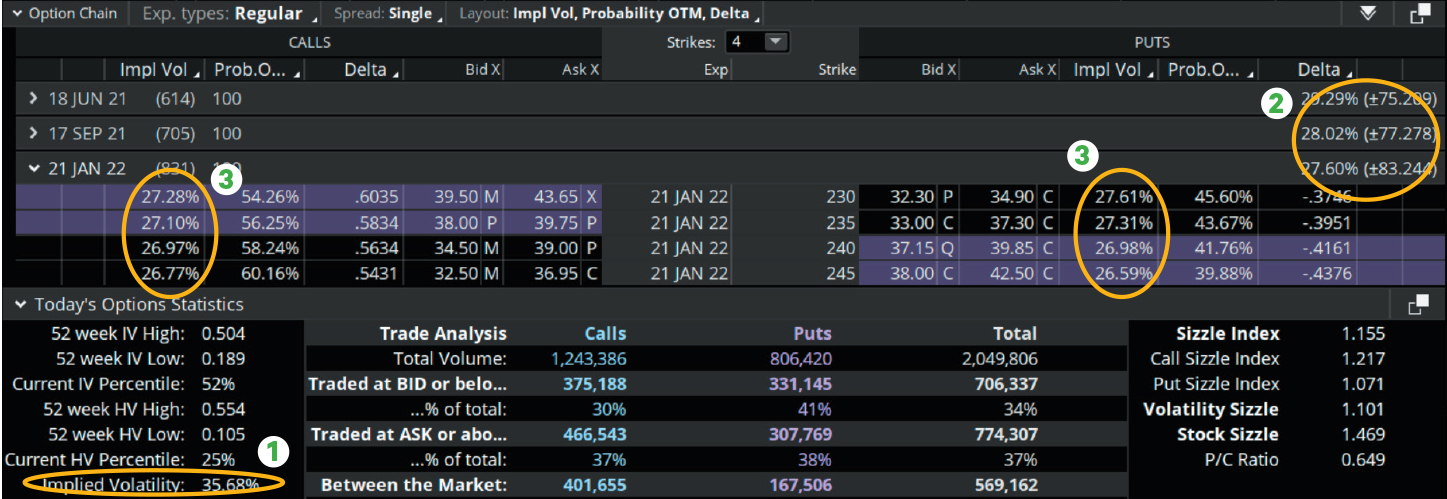

Vol Whisperer So Many Vol Readings Which One Do I Use Ticker Tape

Calculating Regulatory Aum Vs Assets Under Advisement Aua Regulatory Asset Management

Pin By Penny Stocks On Penny Stocks Penny Stocks To Buy Penny Stocks How To Raise Money

Using The Account Statement On Thinkorswim Youtube Accounting Educational Videos Loss

What S My Potential Income The New Dividend Income E Ticker Tape

The Best Retirement Calculator Review I Review 26 In One Day Calculatormountain Chief Mom Officer Retirement Calculator Cnn Money Retirement

Simple Moving Averages Make Trends Stand Out In 2021 Online Broker Investing In Stocks Trading Strategies

Organize Your Finances The Definitive Guide Finance Sinking Funds Organization

What Is Cash Reserve Ratio Statutory Liquidity Ratio Crr Vs Slr Fintrakk Banking Institution Best Credit Cards Cash

What S My Potential Income The New Dividend Income E Ticker Tape

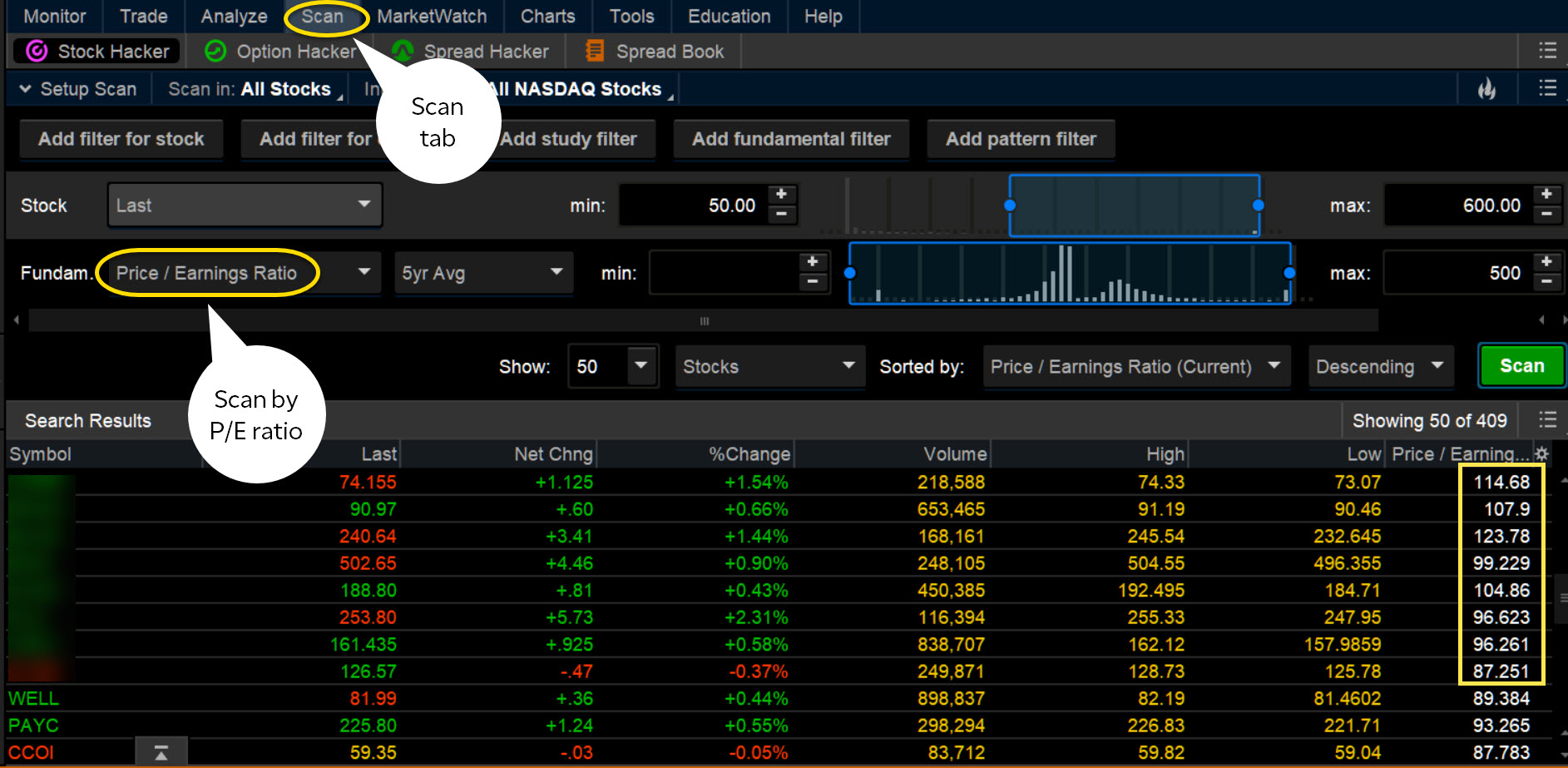

Price To Earnings Ratio The Price Is Right Right Ticker Tape

High Cash Value And Long Term Growth Privatized Banking Life Insurance Policy Term Banking